By Chika Madubuike-Onuora –

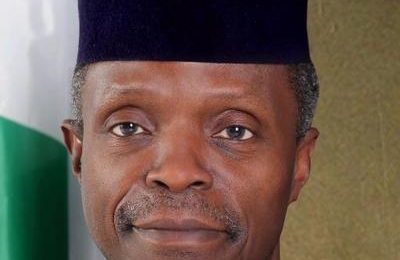

Resolutely navigating turbulent seas spawned by a mix of micro and macro-economic triggers, the nation’s apex bank – Central Bank of Nigeria (CBN) led by Dr. Godwin Emefiele – has provided circumspect, stabilizing guidance which is being reflected in identifiable growth positives.

From its recent report flowing from her Article IV consultation with Nigeria, the Executive Board of the International Monetary Fund (IMF) confirms that Nigeria’s economy is recovering.

Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials of the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

According to the Bretton Woods Institution, Nigeria’s real GDP increased by 1.9 percent in 2018, up from 0.8 percent in 2017, on the back of improvements in manufacturing and services, supported by spillovers from higher oil prices, ongoing convergence in exchange rates and strides to improve the business environment.

More – headline inflation also fell to 11.4 percent at end-2018, reflecting declining food price inflation, weak consumer demand, a relatively stable exchange rate and tight monetary policy during most of 2018, but remains outside of the CBN’s target range of 6-9 percent.

Still identifying more positives, the IMF noted that record holdings of mostly short-term local debt and equity and a current account surplus lifted gross international reserves to a peak in April 2018, while the three-times oversubscribed November 2018 Eurobond helped cushion the impact of outflows later in the year.

Further significant pointers to economic stabilization are that risks are moderately tilted downwards. On the upside, oil prices could rise (they are actually rising), prompted by global political disruptions or supply bottlenecks. Bold policy tweaks and reform efforts, following the election cycle, are boosting confidence and investments, especially given relatively conservative baseline projections.

On the flipside, additional delays in reform implementation, a persistent fall in oil prices, reduced oil production, increased security tensions, or tighter global financial market conditions could undermine growth, provoke a market sell-off, and put additional pressure on reserves and/or the exchange rate.

The Executive Directors of IMF further welcomed Nigeria’s ongoing economic recovery, accompanied by reduced inflation and strengthened reserve buffers. They noted, however, that the medium-term outlook remains muted, with risks tilted to the downside. In addition, long standing structural and policy challenges need to be tackled more decisively to reduce vulnerabilities, raise per capita growth, and bring down poverty. They therefore, urged the authorities to redouble their reform efforts and supported their intention to accelerate implementation of their Economic Recovery and Growth Plan.

Beyond acknowledging emerging positives, the IMF also stressed the need for revenue-based consolidation to lower the ratio of interest payments to revenue and making room for priority expenditure. They welcomed the authorities’ tax reform plan to increase non-oil revenue, including through tax policy and administration measures and stressed the importance of strengthening domestic revenue mobilization, including through additional excises, a comprehensive VAT reform, and elimination of tax incentives.

They observed that securing oil revenues through reforms of state owned enterprises and measures to improve the governance of the oil sector will also be crucial. However, restructured loans and undercapitalized banks continue to weigh on financial sector performance but this could be mitigated with the strengthening of capital buffers and risk based supervision and revamping the banking resolution framework.

With significant improvements in the quality and availability of economic statistics, reflecting the proactive and inclusive footing of the CBN, the apex bank is also aiding the reinvigoration of reforms to diversify the economy and achieve the Sustainable Development Goals. It is of course no secret that the CBN has aided improvement of the business environment, implementing the power sector recovery program and deepening financial inclusion.

To critical industry stakeholders, Emefiele certainly deserves kudos for keeping faith and demonstrating focused commitment and professionalism in a particularly challenging period of the national journey. His track record of unambiguous performance at the nation’s apex bank is unassailable.

It’s worth recalling that as at June 2015 when Emefiele assumed duty, Nigeria’s reserves had fallen from a peak of US$62b in 2008 to only US$37b! But following the sharp drop in crude oil prices, the nation experienced a plummeting of the CBN’s monthly foreign earnings, from as high as US$3.2 billion to current levels of as low as US$700 million monthly. To avoid further depletion in the reserves, the CBN took a number of countervailing actions including the prioritization of the most critical needs for foreign exchange.

In this regard, and in order of priority, it decided to provide the available but highly limited foreign exchange to meet critical needs as – Matured Letters of Credit from Commercial Banks, Importation of petroleum products, Importation of critical raw materials, plants, and equipment, Payments for School Fees, BTA, PTA, and related expenses.

Over the intervening period, it is heartening to note that these policies yielded positive results. In particular, the CBN managed to stabilize the exchange rate around February 2015, thereby creating certainty for both household and business decisions. It largely eliminated speculators and rent-seekers from the Foreign Exchange Market.

Reserves, despite having fallen, are still robust and able to cover about 5 months of Nigeria’s imports as against the international benchmark of 3 months. The domestic production of items prohibited from the FX market is picking up nationwide, thereby creating more jobs for many more Nigerians.

The demand for foreign exchange by mostly domestic importers has risen significantly. For example, the last time the nation had oil prices at about US$50 per barrel for an extended period of time was in 2005. At that time, the average import bill was N148.3 billion per month. In stark contrast, Nigeria’s average import bill for 2015 was over N1 trillion monthly, though oil prices are now less than US$60 per barrel but picking up.

The net effect of these combined forces unfortunately is the depletion of the nation’s foreign exchange reserves. Currently, the stock of Foreign Exchange Reserves has declined to around US$25.4 billion. To avoid further depletion in the reserves, the CBN under the nimble guidance of Governor Emefiele took a number of countervailing actions including the prioritization of the most critical needs for foreign exchange.

Further, as part of its long-term strategy for strengthening the Nigerian economy, the Bank established specific initiatives to resolve the underlying factors goading challenges to long-term GDP growth, economic productivity, unemployment and poverty that had pervaded the economy over the past decades. Hence, the CBN took measures to increase credit allocations to pivotal productive sectors of the economy. This is with a view to stimulating increased output in these sectors, creating jobs on a mass scale and significantly reducing import bills.

These targeted interventions have so far impacted such sectors as Agriculture, Power, Micro, Small and Medium-Scale Enterprises (MSMEs), Workers’ Salary/Pensions Assistance Fund, Infrastructural Assistance for States, Emergency Fiscal Spending, Improving Foreign Exchange Supply and Financial Inclusion. Going forward, it’s not doubtable the future is very bright.

Ms. Madubuike-Onuora contributed this piece via chikamadubuikeonuora@gmail.com